Welcome to 2026 to all our readers.

As Asian Glass opens its first issue of 2026, the industry finds itself at a decisive moment, shaped by sustainability imperatives, technological acceleration and evolving market dynamics across regions. This edition reflects how glass manufacturers, processors and suppliers are responding to these shifts, balancing capacity growth with efficiency, compliance and innovation.

Our cover story turns the spotlight on Egypt, the first market featured in our new Country Focus series. With a population of more than 115 million, a robust construction sector and rising disposable incomes, Egypt has emerged as one of the largest flat and processed glass producers in the Middle East and North Africa. Significant capacity additions, a growing domestic market and its strategic position as a regional manufacturing and export hub have strengthened the country’s role in the global glass supply chain. This focused overview examines the key factors shaping Egypt’s glass industry, including demand drivers, recent investments, policy developments and the opportunities and challenges facing producers as the market continues to expand.

Regulation and sustainability remain defining themes across Asia. Governments are tightening oversight of the glass industry, enforcing stricter environmental standards, improving energy efficiency and strengthening quality compliance to manage rising production levels. Measures such as emission controls, the adoption of green manufacturing technologies and the use of third-party certification are becoming increasingly widespread, while trade policies including anti-dumping duties continue to influence regional competitiveness. Major markets such as India and China are accelerating upgrades towards Industry 4.0, seeking to enhance productivity while lowering carbon intensity. Jahir Ahmed explores how these regulatory and policy shifts are reshaping investment priorities and long-term growth strategies.

Packaging is another sector undergoing rapid transformation. From its functional beginnings in the early 20th century, beverage packaging has evolved into a critical commercial and brand differentiator. Changing lifestyles, increased on-the-go consumption, premiumisation and sustainability concerns are driving producers to reassess packaging formats, materials and technologies. In this feature, Yogender Singh Malik examines how Asia’s beverage industry is responding to consumer expectations while balancing cost, logistics and environmental impact.

Energy-efficient and coated glass technologies continue to gain momentum across the region. Low-emissivity glass, alongside reflective, anti-reflective and smart glass solutions, is increasingly central to applications in construction, automotive, solar and electronics. Driven by green building mandates, tighter energy regulations and sustained investment, Asia has become the world’s fastest-growing market for coated glass. China, Japan and South Korea remain at the forefront of innovation, production and adoption, a trend analysed by Jahir Ahmed.

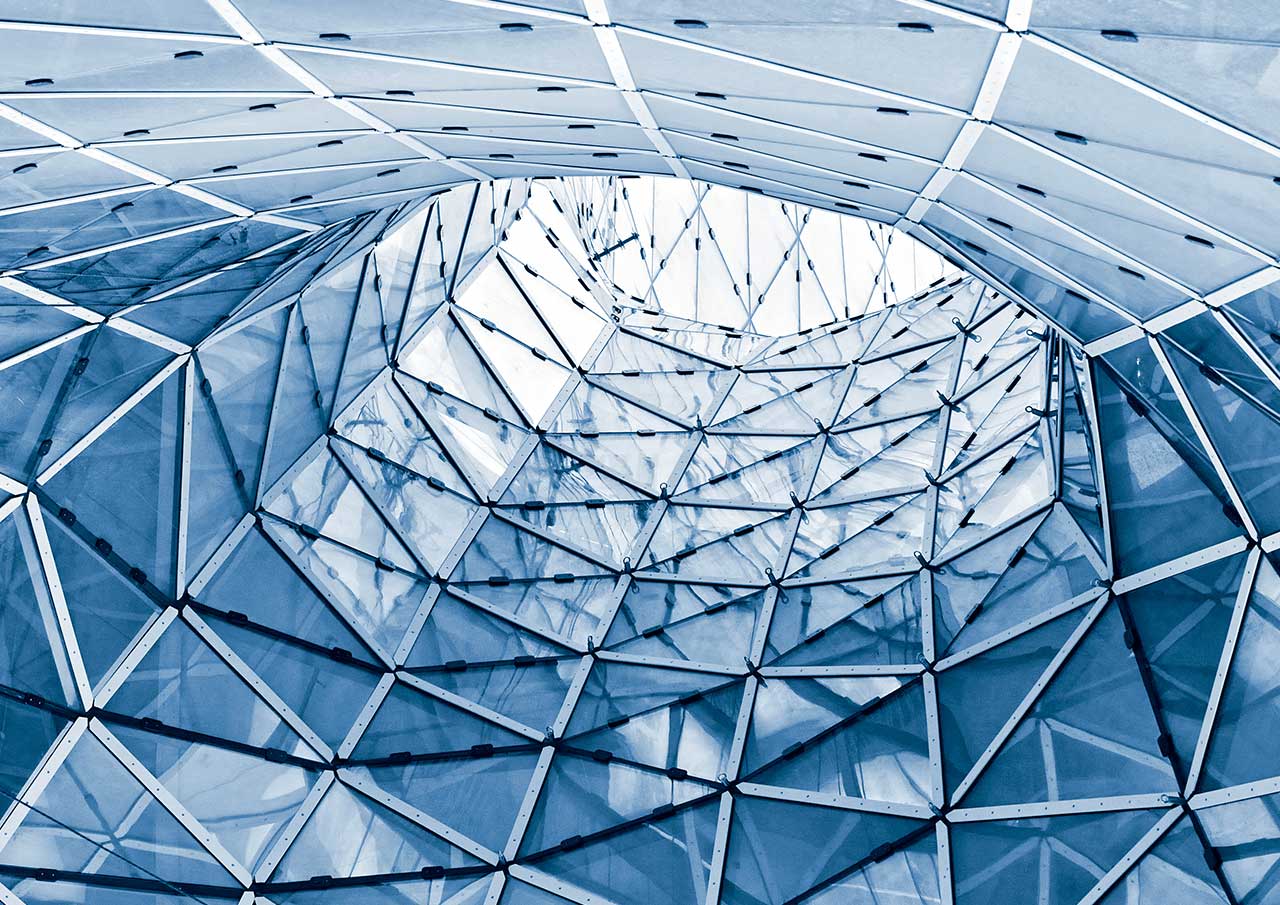

Architectural design is also being reshaped by advances in glass processing. Curved glass and sophisticated facade articulation are enabling architects to move beyond flat, monolithic forms, introducing fluidity and visual interest into urban skylines. Improvements in machinery and fabrication techniques are supporting this shift, as explored by Rohan Gunasekera.

Digital transformation continues to accelerate on the factory floor. From the hot end to the cold end, artificial intelligence is being deployed to optimise processes, improve quality and reduce waste. Despite cost considerations, manufacturers increasingly view AI as a strategic necessity rather than an optional upgrade, a theme continued in our Tech Focus.

We also feature an interview with Alain Bretthauer of Chemetall, the surface-treatment business unit of BASF Coatings, on how the company is supporting glass manufacturers in Asia through advanced chemical solutions, expanded regional partnerships and a strong commitment to sustainability.

We hope this issue provides insight, perspective and inspiration as the industry moves confidently into 2026.

Inside the current issue

News, views, raw materials, comment and much, much more!

See us at:

Check out a sample issue

Follow the link to download a whole sample issue for yourself and see what AG has to offer Read it nowSubscribe

Stay up to date with the latest news and features!

Advertise

Intuitive, bespoke, highly effective marketing campaigns.

Editorial

Download our editorial features schedule today.

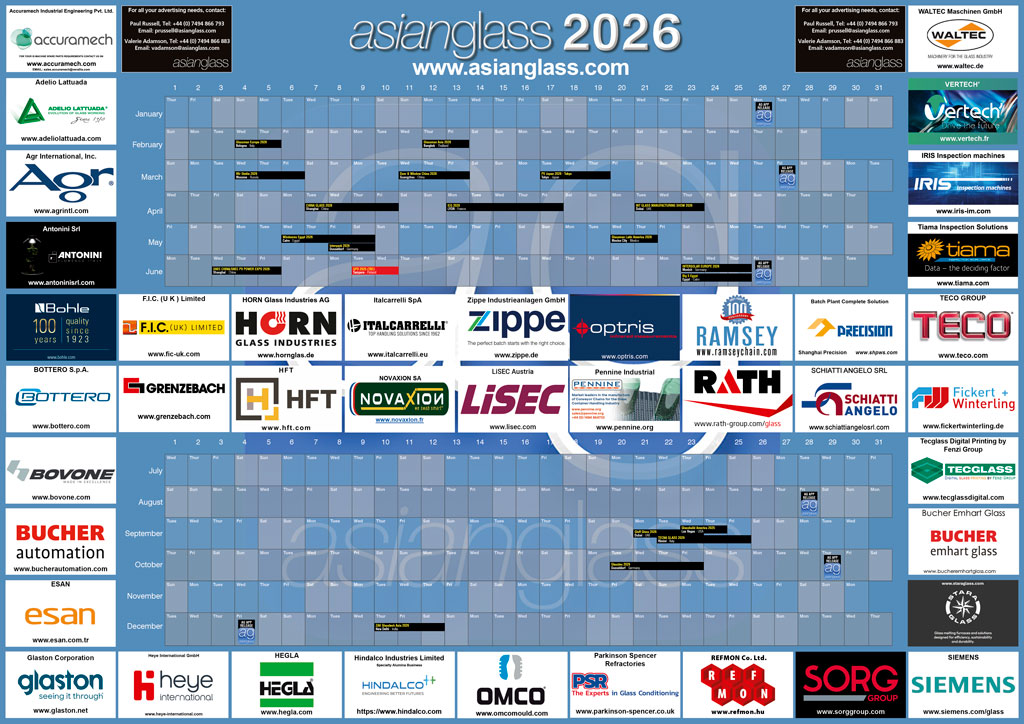

Year Planner

Map out your business year with our free to download calendar.